federal estate tax exemption 2022

Estate Tax Exemption goes up for 2022 For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million today.

What Happened To The Expected Year End Estate Tax Changes

Up from 117 million for 2021 the 2022 exemption amount will be 1206 million.

. If you have an. For people who pass away in 2022 the exemption amount will be 1206 million its 117. The provision would also affect the taxation of gifts.

Below is a summary of the current federal estate gift and generation-skipping transfer tax provisions for 2022. Employers engaged in a trade or business. Employers Quarterly Federal Tax Return Form W-2.

Bureau of Labor Statistics Consumer Price Index. As of January 1 2022 that will be cut in half. The federal estate tax limit will rise from 117 million in 2021 to 1206 million in 2022.

Trusts and Estate Tax Rates of 2022. The federal estate tax exemption provides that an estate with a value below the exemption amount can be passed on tax-free. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service.

As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. From Fisher Investments 40 years managing money and helping thousands of families.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. The federal estate- and gift-tax exemption applies to the total of an individuals taxable gifts made during life and assets left at death.

The effect of the change would be to reduce the basic exclusion amount for estate tax purposes to 602 million for 2022. Earlier this week the IRS released the federal estate tax exemption for 2022. While only a small percent.

The 2022 exemption is 1206 million up from 117 million in 2021. As of early 2022 the exemption amount is 1206 million. Get information on how the estate tax may apply to your taxable estate at your death.

Ad Take out the guesswork with The Investors Guide. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Note that under current law the increases in exemption.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Heres a look at how this exemption has changed over the. Put simply this will only affect you if the.

So how does this affect you. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. From Fisher Investments 40 years managing money and helping thousands of families.

12 rows For 2022 the personal federal estate tax exemption amount is 1206 million it was 117. 2021-2022 Federal Estate Tax Rates. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

24 rows On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is. The federal gift tax limit will jump from 15000 in 2021 in effect since 2018 to 16000. In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The federal estate tax exemption for 2022 is 1206 million. Federal Estate Tax Exemption As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021.

The IRS adjusts the federal transfer tax exemption amounts for inflation each year. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

The 2022 exemption is 1206 million up from 117 million in 2021. Your estate wouldnt be. Above the exemption the.

As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately 6020000 per person or 12040000 for a married couple. Lower Estate Tax Exemption. Estate Gift and Generation-Skipping Transfer Tax Exclusion Amounts for 2022.

The first 1206 million of your estate is therefore exempt from taxation. 18 0 base tax 18 on taxable amount.

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds In 2021 Capital Gains Tax Tax Brackets Irs Taxes

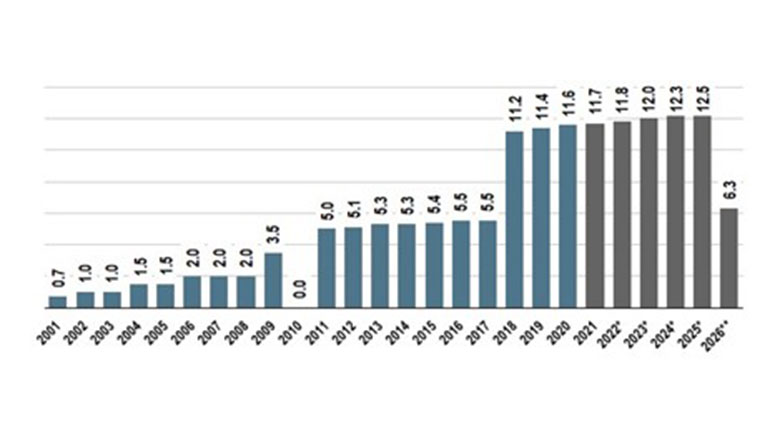

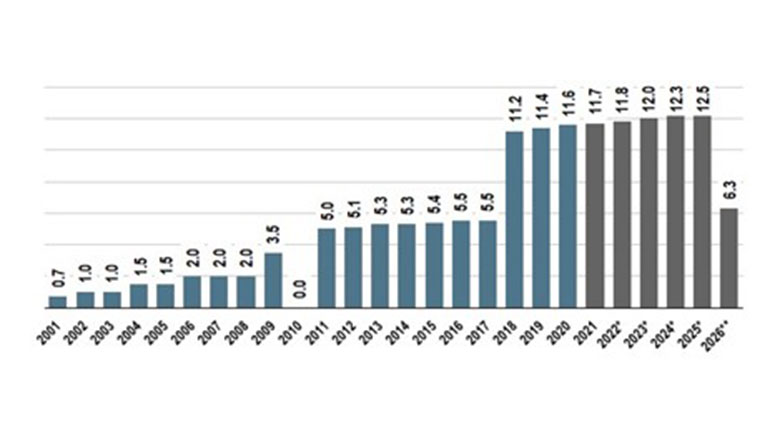

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Federal Income Tax Tuition Payment Tax

What Canadian Businesses Need To Know About U S Sales Tax Madan Ca

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

10 Ways To Be Tax Exempt Howstuffworks

As A Small Business Owner Or As An Individual Your Charitable Donations Are Tax Deductible Here 39 S How They Are Estate Tax Charitable Donations Charitable

Irs Announces 2015 Estate And Gift Tax Limits Money Making Business Tax Deductions Estate Tax

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Are Estate And Gift Taxes And How Do They Work

What Is A Homestead Exemption And How Does It Work Lendingtree

How Do Millionaires And Billionaires Avoid Estate Taxes

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj